Many banks today leverage online data to understand and respond to their customers’ behaviours. However, a significant blind spot remains: the invaluable insights hidden within customers’ offline banking transactions.

While some organisations attempt to combine online and offline data, they often miss the true nuances of offline behaviours by relying on basic aggregations. This oversight results in numerous missed opportunities for banks to identify crucial triggers and events in offline data that could significantly enhance event-based marketing objectives.

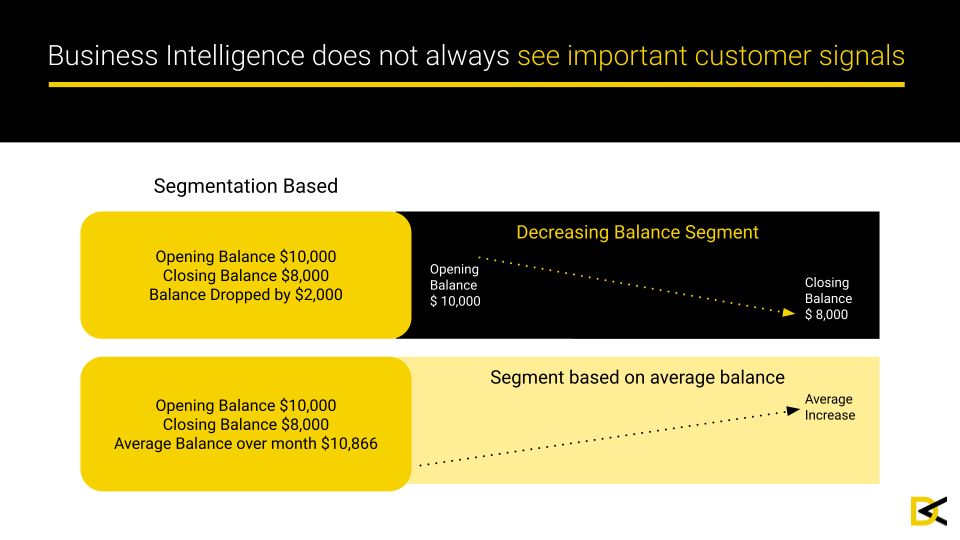

Most banks have dedicated Analytics or Business Intelligence teams that meticulously examine customer data to craft segments, reports, and build propensity models. While these segments are frequently employed in marketing efforts, a common pitfall we’ve observed is the tendency to create them based on broad aggregations.

For instance, tracking a decreasing or average account balance over a month. While such metrics offer some utility, they frequently fail to detect subtle yet powerful signals indicating a customer’s immediate need for a banking product, such as a home loan. Consequently, critical opportunities are overlooked.

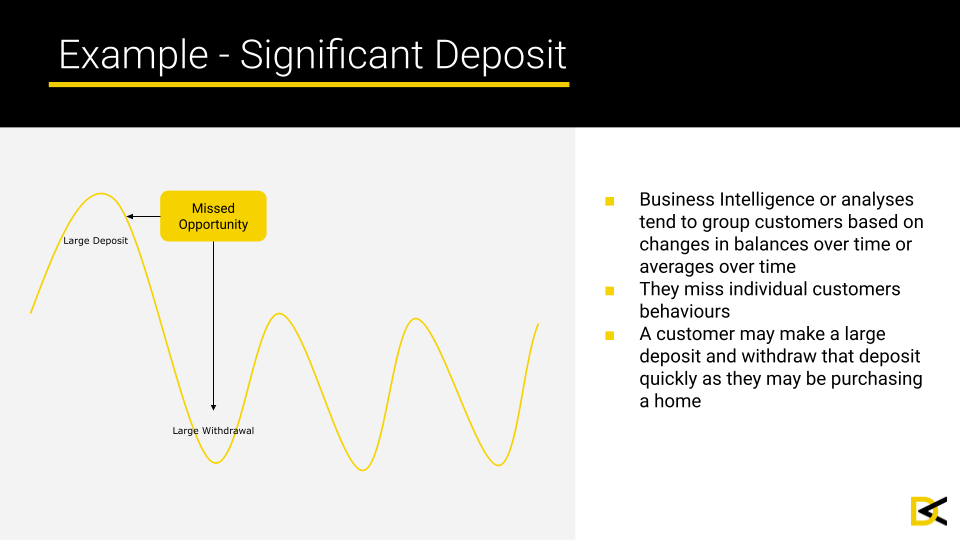

To illustrate, consider the power of analysing individual transactions rather than just aggregates over time. Imagine a scenario where a customer makes an unusually large deposit, only to withdraw that exact amount a few days later. This could signify the sale of a home or a significant windfall, followed by the purchase of another property or a substantial investment. If marketers solely depend on aggregated segments, this crucial signal might be missed, as the average balance may not be sufficiently impacted over a month to trigger an alert.

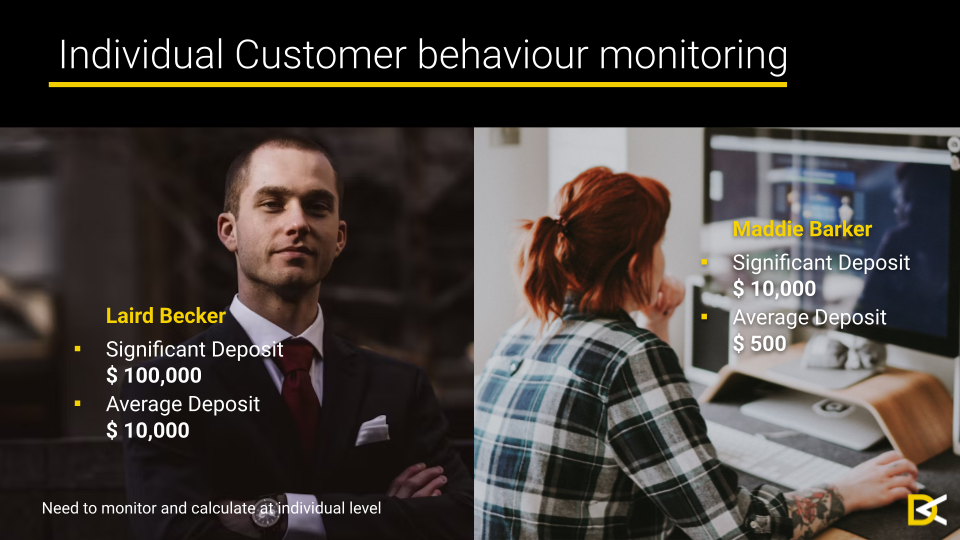

It is paramount that the identification of significant or unusual transactional events is conducted at an individual customer level, not merely within predefined segments (e.g., high value, medium value, low value). The reason is simple: every customer is unique. What constitutes a “significant” deposit for one customer may be entirely normal for another.

For example, Maddie, an Uber driver with an average deposit of $500, would consider a $10,000 deposit highly significant. In stark contrast, Laird, the son of a wealthy businessman, has an average deposit of $10,000. While this is significant for Maddie, it’s not for Laird; for him, a truly significant deposit would be substantially larger, perhaps $100,000.

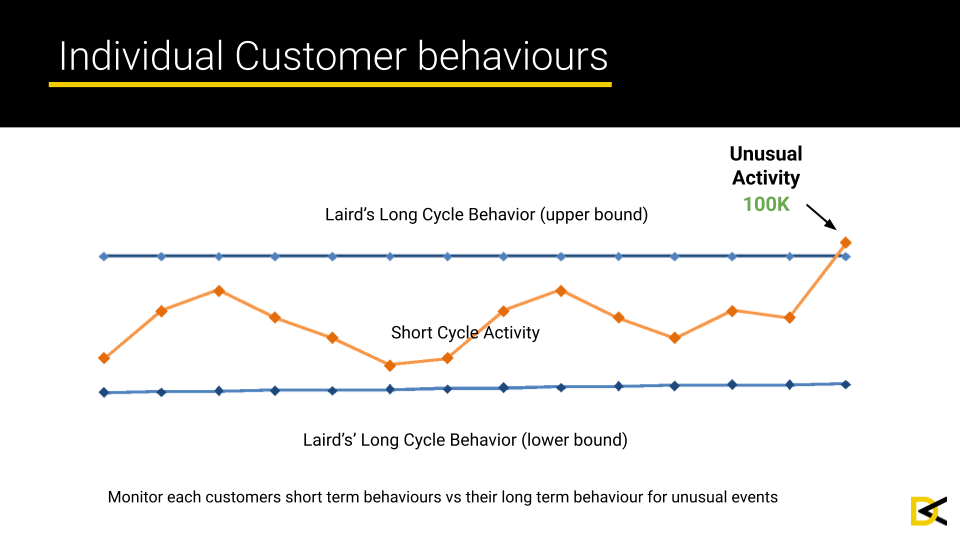

Uncovering unusual events at the individual customer level necessitates a deep dive into each person’s unique behavioural patterns, moving beyond segment-level or whole-customer-base analysis. By establishing upper and lower bounds based on a customer’s long-term transaction behaviours, as depicted in our diagram for Laird, recent activity can be precisely evaluated. If Laird’s recent deposit, for instance, surpasses his established upper bound, it is immediately flagged as unusual or significant, such as the $100,000 deposit we just discussed.

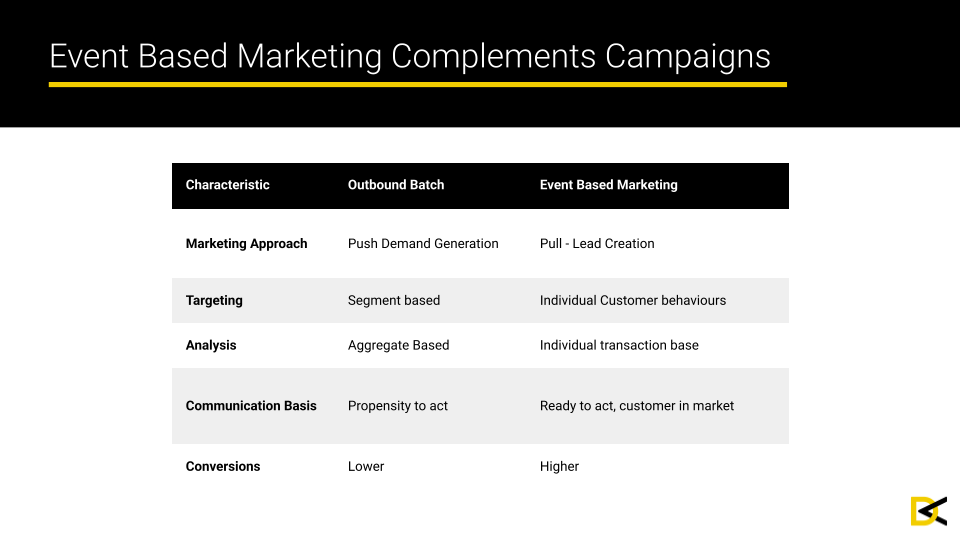

Let’s define the distinct advantages of event-based marketing campaigns over traditional campaign approaches.

The fundamental approach differs considerably. A conventional campaign typically aims to generate demand by broadly disseminating messages and offers to customer segments presumed to be interested in a product. Targeting is often segment-based, relying on aggregations and machine learning techniques like propensity models. Communication channels tend to be lower-cost options such as email, in-app push notifications, or web personalisation.

Conversely, event-based marketing acts directly on individual customer behaviours, transforming them into actionable leads. When a customer executes a very specific action (e.g., an unusual deposit), they are inherently in-market and primed to act. Such campaigns can justify the use of higher-cost channels, like call centres, given the high-quality nature of the leads. We have consistently observed remarkable success with this approach.

While the sheer volume of customers engaged in event-based marketing might be lower, the conversion rates are generally significantly higher. Crucially, communication must be not only timely but also delivered with serendipity. Customers appreciate discretion; they don’t want to be explicitly told that their bank is aware of their unusually large deposit. For example, a call centre interaction could be framed as a proactive “health check” call.

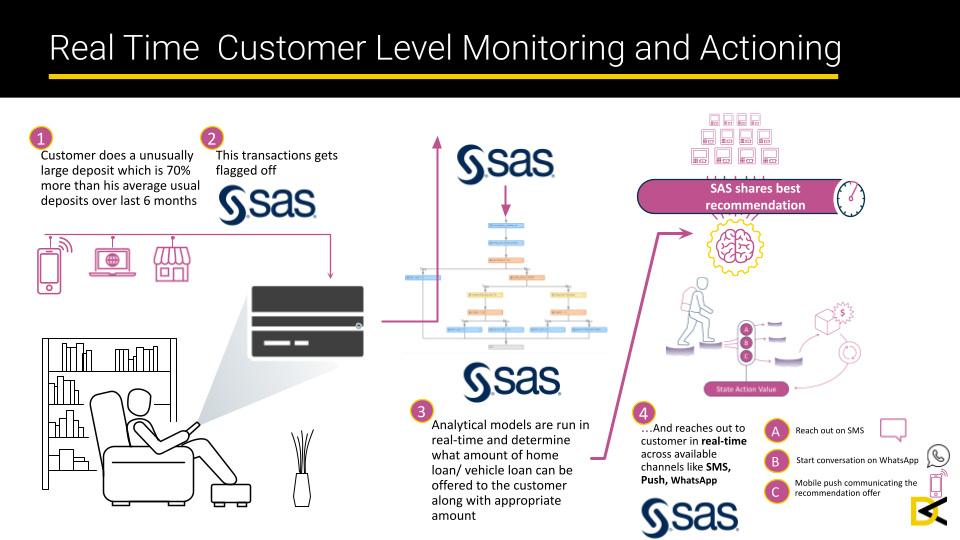

Our process begins with a customer making an unusually large deposit, say, 70% higher than their average over the preceding six months. This immediately triggers a system flag. Real-time analytics spring into action, instantly assessing the customer’s eligibility for a home or vehicle loan and calculating suitable loan amounts. The personalised offer is then communicated without delay across multiple channels, including SMS, Push, and WhatsApp.

Our system leverages SAS Technology components: SAS CI360 for orchestrating the customer journey, SAS ESP for real-time transaction processing, and SAS Intelligent Decisioning for generating the optimal next best offer instantaneously.

Here are some examples of campaigns powered by triggers and events.

Significant deposit event

A timely identification of a significant deposit using SAS could indicate several scenarios:

Credit Cards

Event: Unusual payment

In this instance, a bank customer is a “revolver”, typically paying only a small portion of their credit card balance each month, generating regular interest for the bank. Through SAS, an atypical payment is detected: the customer has made a large payment and settled their entire balance. This could signal a fundamental shift in the customer’s financial situation. Potential campaigns could include a credit limit increase or other targeted incentives.

Other credit card triggers could be:

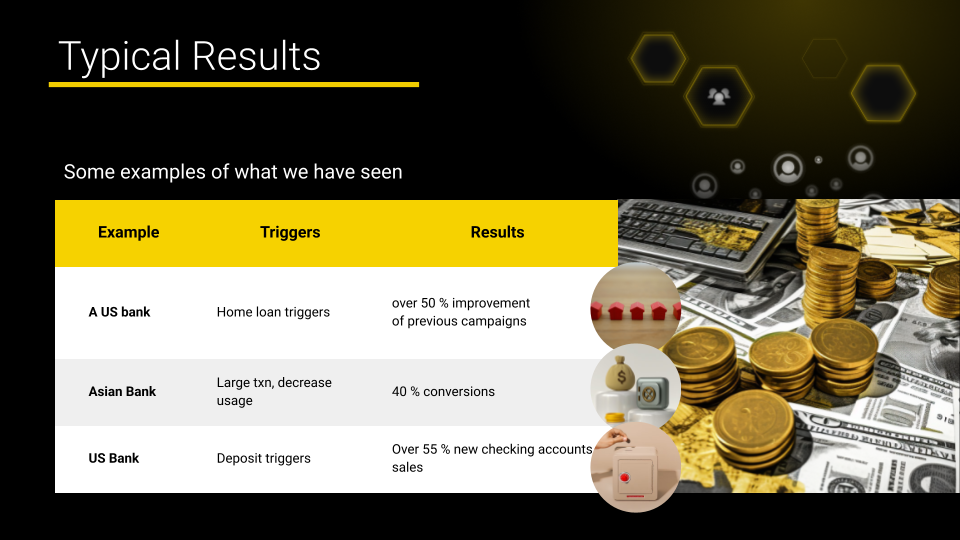

The integration of transactional triggers and events into a bank’s capabilities consistently yields impressive results. Here are typical outcomes we’ve observed:

Digital Alchemy boasts a comprehensive event and trigger library, complete with corresponding campaigns within our Automation by Design framework. It’s crucial to recognise that executing at scale involves hundreds of triggers and events, requiring a seamless process for design, execution, and measurement.

Curious to see how Digital Alchemy can help transform your customer conversations?

Contact us today to discuss your campaign roadmap!